oregon tax payment deadline

What are the specific Oregon tax returns for which filing deadlines have been postponed to May 17 2021. Taxpayers that have substantial nexus with Oregon must pay taxes on their Oregon commercial activity.

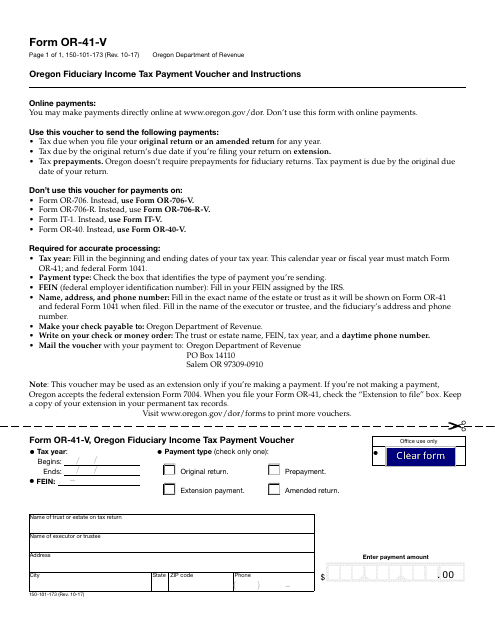

.png)

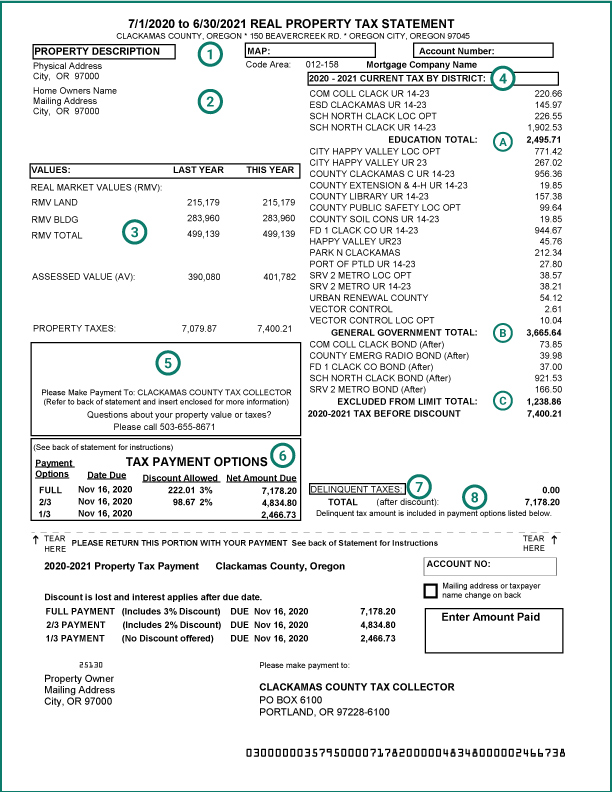

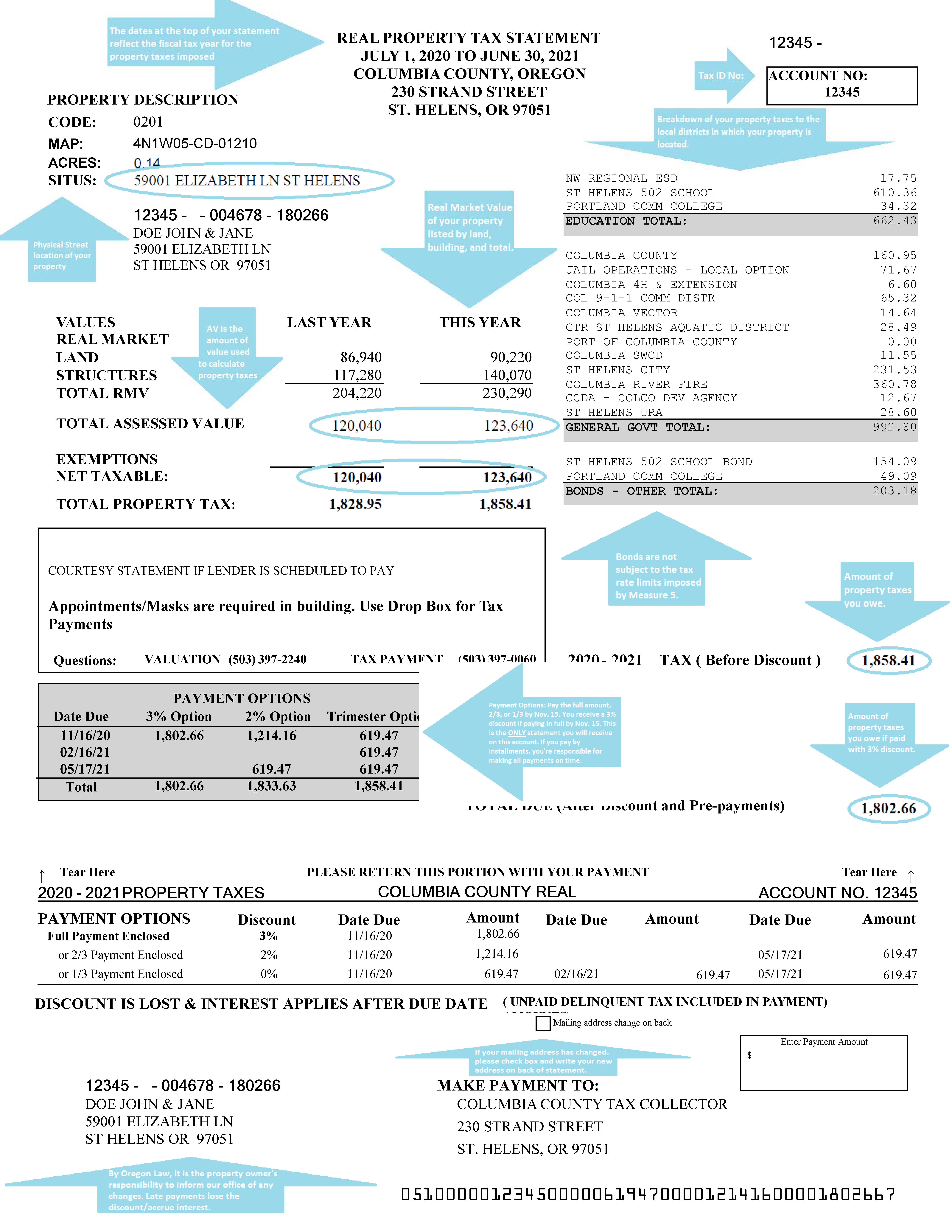

Columbia County Oregon Official Website Understanding Your Property Tax Statement

An ODR spokesperson confirmed Wednesday that May 17 was the new cut-off date for Oregonians to file their state taxes for 2020.

. If you have any questions the tax office is open during regular business hours. The due dates for estimated payments are. 2021 TriMet and Lane Transit District self.

April 18 2022. What are the specific Oregon tax returns for which filing deadlines have been extended to May 17 2021. Service provider fees may apply.

Tax filing and payment due dates for individuals from April 15. Commercial activity generally means a persons or unitary groups total amount realized from. April 15 July 31 October 31 January 31.

The deadline to file state and federal personal income tax returnsApril 18th and the Oregon Department of Revenue estimates that it. This automatic Oregon tax filing and payment deadlines extension incorporates some but not all of the elements of the federal income tax filing and payment deadlines extension. SALEM Oregonians now have until July 15 to file and pay their 2019 state personal or business income taxes.

In order to make the quarterly payments either use Oregon Voucher OR-21-V or make the online payment through the entitys Revenue. Find IRS or Federal Tax Return deadline details. 2021 statewide transit individual tax returns and balance-due payments.

As a result interest and penalties with respect to the Oregon tax filings and payments extended by this order will begin to accrue on July. Oregon Corporate Activity Tax payment deadline July 31 2020. The IRS and the respective State Tax Agencies require you to e-file a Federal Income Tax Return at the same time you e-file a State Tax Return.

Oregon recognizes a taxpayers federal extension. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Form OR-40 OR-40-N and.

Accordingly the first CAT payment is due April 30 2020. The tax year 2019 six-month extension to file if requested continues to extend only the filing deadline until October 15 2020. Corporate Income and Excise.

Therefore the director has issued Directors Or der 2021-01 ordering an automatic postponement of the 2020 tax year filing and payment dates for individual Oregon taxpayers to May 17 2021. The Oregon Department of Revenue has announced that the state of Oregon will automatically extend the tax filing and payment deadline for individual taxpayers to May 17 2021. 2021 individual income tax returns and balance-due payments.

The Oregon tax filing and tax payment deadline is April 18 2022. The Oregon Department of Revenue DOR intends to follow guidance from the IRS when more details become available. Individual taxpayers who need additional time to file beyond the May 17 deadline can request a filing extension until October 15 by filing federal Form 4868 through their tax professional or tax software or by using the Free File link on IRSgov.

The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Electronic payment from your checking or savings account through the Oregon Tax Payment System. Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount owed.

Estimated tax payments for tax year 2020 are not extended. According to Rich. Tax Returns Due April 18th.

Oregon Corporate Activity Tax payment deadline remains April 30. The Oregon Department of Revenue released more. But any quarterly payments for 2020 still will be due April 15.

With property taxes due on the following Nov. 2022 first quarter individual estimated tax payments. Choose to pay directly from your bank account or by credit card.

The Oregon Department of Revenue anticipates receiving more than 2 million tax returns in a year. The dates at the. Form OR-40 OR-40-N and OR-40-P Oregon Personal Income Tax Returns Form OR-STI.

Both the IRS and the Oregon Department of Revenue will. Corporate Income and Excise. An extension to file is not an extension to pay.

As of July 10 the agency has received just over 18 million returns thus far. Monday through Friday from 800 am. Oregon has not extended the due date of the first payment for its new Corporate Activity Tax CAT.

Mail a check or money order. The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July 15 2020. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

Oregon has joined the Internal Revenue Service IRS in postponing the tax filing and payment due dates for individuals from April 15 2021 to May 17 2021. Tax filing and payment due dates for individuals from April 15 2021 to May 17 2021. Individual taxpayers including those who pay self-employment tax can also postpone state income tax payments due on their 2020 tax year return until May 17 2021 according to a release from the Oregon Revenue Department.

Due Date Extension. Taxpayers must make their second payment for Oregons new Corporate Activity Tax CAT by July 31 2020. Income tax deadline has been moved from April 15 to May 17.

2021 trust and estate returns and payments. Senior and disabled property tax deferral applications. During Wednesday mornings conference call with the media Governor Kate Brown said personal filing deadlines will be extended until July 15.

Directors Order 20-01 extended the Oregon tax filing and payment deadline from April 15 2020 to July 15 2020. Photo Metro Creative Connections. Electronic payment using Revenue Online.

Or Or Wr 2018 2022 Fill Out Tax Template Online Us Legal Forms

E File Oregon Taxes For A Fast Tax Refund E File Com

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

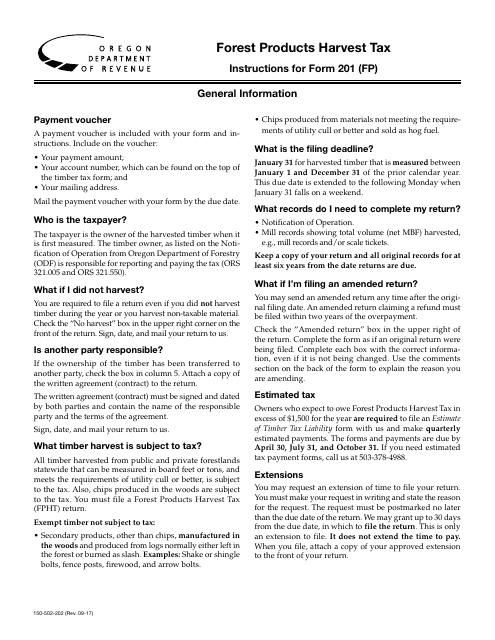

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Understanding Your Property Tax Bill Clackamas County

Filing An Oregon State Tax Return Things To Know Credit Karma Tax

Columbia County Oregon Official Website Tax Office

Oregon Ifta Fuel Tax Requirements

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Oregon S Business Alternative Income Tax For Pass Through Entities Jones Roth Cpas Business Advisors

Blog Oregon Restaurant Lodging Association

Columbia County Oregon Official Website Understanding Your Property Tax Statement